Building Zomia

Problem

Every year, tens of thousands of students across Myanmar finish high school but cannot continue their studies because they lack access to funding for college. Education is not free and there is no government loan program or assistance. Of the private loan options that do exist, the terms are unattractive and difficult to obtain.

When we started Zomia in 2014, peer-to-peer (P2P) lending was on the rise. Most promising, P2P lending models reduced risk. Instead of a bank providing a single $10,000 loan (and owning all of the risk), P2P lending could allow for 100 people to each contribute $100 to provide the borrower with a $10,000 loan.

Challenge

Could a P2P lending solution help fill the financial aid gap in Myanmar? Could we connect people to students through affordable education loans?

Role: Co-founder, Product Manager

Impact: Zomia lenders have helped 145 students achieve a higher education and join the formal financial system. >$600,000 (since Feb. 2020) is managed on zomia.org today.

Process

Discovery

User survey

Competitive Audit

Definition

User stories & epics

Prioritization

Delivery

The Build

Beta and GA rollout

Discovery

P2P lending intrigued us but we knew very little about it. In addition to secondary research, we wanted to understand firsthand how lenders use P2P lending platforms, why, and what they valued most from them.

Survey

We surveyed “power users” on a leading P2P lending site about their experiences. Those who participated received a $25 gift card to use on the site. We defined power users as lenders with a photo, “About Me” section completed, and >$50,000 on the site.

11 of the 128 lenders we contacted submitted the survey. Considering we had no website, brand, or recognition, we considered this sample size a success. The group had cumulatively funded >$750k on the platform.

Competitive audit

We compiled a list of features and functionality across four other leading P2P lending sites. We wanted to learn which features/functions were shared and which were unique. This would help us understand what lenders might expect from zomia.org and where we might be able to add unique value.

What we learned

Online survey

Why do lenders lend?

“Effective altruism”—defined as the use of evidence and reasoning to determine the most effective ways to benefit others—was cited multiple times as the motivation for lending.

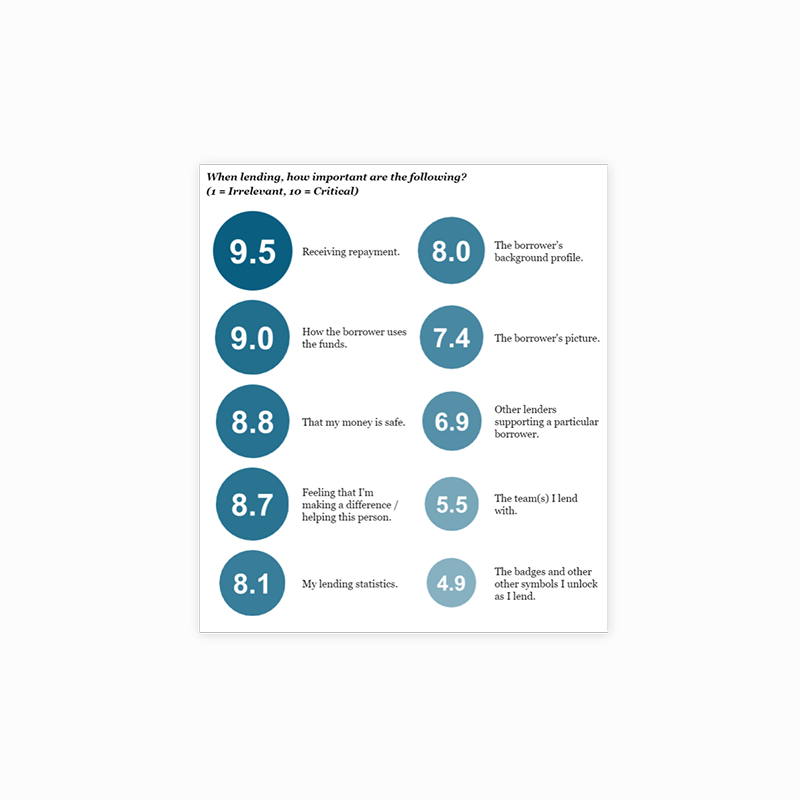

What do lenders value?

Despite logging in infrequently, lenders highly valued their account dashboard and the community aspect of the site (joining a group/team, exchanging messages).

How do they use the site?

Most lenders funded loans that were either entering repayment soon or had short repayment horizons. Two lenders kept a large portion of their retirement savings on the site and a third used it for her niece’s college savings fund. All three believed that others should be able to use their money while they didn’t need it.

Competitive audit

Plumbing required

The infrastructure required to facilitate P2P lending was significant.

Lender focused

All sites served lenders, not borrowers. Borrower data were only posted to the platform while partners serviced the loans.

Audience types

Platforms offering returns built financial management tools while social/benefit platforms focused on gamification, community, and impact.

Definition

After completing the survey and audit, we brainstormed possible Zomia MVP platform features. No idea was off limits. We then wrote these ideas into formal user stories and epics.

Prioritization

Ideas documented, we began a loop of prioritizing, clarifying, and redefining features until the MVP began to take shape. In the last prioritization round, we used Pairwise rankings — a rankings methodology employed by NCAA hockey — to define the most critical features.

We also weighted the rankings to balance lender desires, Zomia priorities, and the technical feasibility of each feature.

By the end of this process, everyone knew what we were building and why. We had a defined platform MVP on paper, from table stakes to nice-to-haves. The energy in the room of the last prioritization meeting was at an all-time high!

Delivery

After an eight-month build, zomia.org went live with a nine-week beta. 69 lenders created accounts and funded student loans, exceeding our goal of 50 registrations during beta. Cumulatively the group funded >$17,000 in loans.

My responsibilities

Leading the discovery phase (e.g., creating the user study, recruiting and communicating with participants, analyzing and sharing findings, etc.)

Leading feature prioritization sessions.

Helping the team define MVP scope.

Writing user stories and epics.

Breaking down each feature into actionable tasks in Asana.

Tracking progress and providing the team with status updates.

Identifying and recruiting beta lenders.

Conducting in-person user sessions during beta.

Conducting QA of the website, flagging and creating tickets for bugs.

Writing content for the website: homepage, buttons, FAQs, tooltips, glossary definitions, blog posts, and student profiles.

In hindsight

We did some things really well…

➜ The discovery phase was comprehensive and laid a solid foundation on which we could build.

➜ With few exceptions, we picked the right battles to fight. We leveraged existing services, plug-ins, templates, etc. before building custom solutions.

➜ We relentlessly automated. No task done repetitively more than a few times lasted long.

➜ We tightly integrated our systems from the start. Everything—from the CRM to the loan management system to our e-mail marketing listserv—talked to each other.

… and had our fair share of learnings!

➜ Not rigorously validating our ideas of what made a P2P platform great hindered our nimbleness in the long run. We built infrastructure around what we assumed would improve the P2P lending experience and that made the platform resistant to future changes.

➜ Waiting eight months to unveil zomia.org inflated expectations and faded excitement.

➜ Not investing in marketing taught us a hard lesson that the internet is a very noisy place to cut new ideas through.

➜ Not hiring freelancers or consultants spread us thin. Designing, coding, marketing, and managing our own tasks ensured everyone slept very little for the better part of a year!